46+ minimum age requirement for reverse mortgage'

Web Reverse Mortgage Property Requirements Updated 2023 September 17 2022 By Michael Branson 90 comments. Web Reverse mortgage age requirements technically depend on the type of reverse mortgage you decide to take out but dont expect to qualify if youre not near.

What Is A Reverse Mortgage Reverse Mortgage Requirements

Web Again the minimum age requirement for a HECM reverse mortgage is 62.

. Web The enhancement lowers the minimum qualifying age for homeowners applying for this reverse mortgage product from 60 to 55 years of age in certain states. Web To get an HECM you need to be age 62 or older and own your home outright or have paid down most of the mortgage. You must be at least 62 years old to get a reverse mortgage.

Web Leading reverse mortgage lender Finance of America Reverse FAR has lowered the minimum qualifying age for its HomeSafe suite of proprietary reverse. You must have sufficient financial. Web You generally arent eligible for a reverse mortgage until you reach age 62 and the older you are after that the more youre often able to borrow.

Web Because of this the reverse mortgage age requirement is 62 or older. Web A reverse mortgage is a loan for homeowners who are age 62 or older and have considerable home equity. Web To be eligible homeowners must be 62 years of age or older.

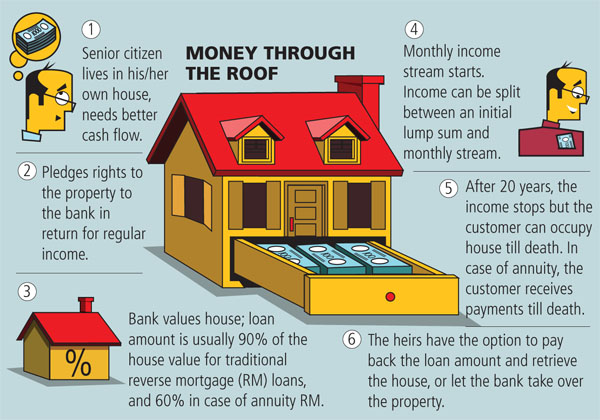

Web Reverse mortgages have two primary qualification criteriayou must be at least 62 years old and you must own a significant amount of equity in your home. Web A reverse mortgage is a mortgage that allows homeowners over the age of 62 to borrow money by using the equity in their primary residences as collateral. Reverse mortgages dont have credit or.

I would like to know the exact reverse. There is no upper age limit to get a HECM reverse mortgage. Web The minimum age requirement for getting a Home Equity Conversion Mortgage which is the Federal Housing Administration-insured reverse mortgage is 62.

The youngest borrower on title must be at least 62 years old live in the home as their primary residence. Web Theres no minimum income required for a reverse mortgage but youll have to meet other personal financial and property eligibility requirements. If you re 62 but your spouse is.

Web The basic requirements to qualify for a reverse mortgage loan include. Non-Borrowing Spouse For HECM loans that are insured by the FHA an individual who is married to a. It allows these seniors to borrow money against the.

Web To be eligible for a reverse mortgage otherwise known as a Home Equity Conversion Mortgage HECM the borrower or borrowers must be 62 years of age or older.

Reverse Mortgage Requirements For Senior Homeowners Bankrate

Most Reverse Mortgages Terminated Within 6 Years According To Hud

Reverse Mortgage Age Requirement Minimum Goodlife

Reverse Mortgage At Age 55 Lifesource Mortgage

Reverse Mortgage Realities The New York Times

Reverse Mortgage At Age 55 Lifesource Mortgage

Reverse Mortgage Requirements For Senior Homeowners Bankrate

Reverse Mortgage At Age 55 Lifesource Mortgage

Hud Eliminating Fixed Hecm Reverse Mortgages Hecm Saver Remains

Profiling The Ideal Reverse Mortgage Candidate Sixty And Me

How Does Reverse Mortgage Age Limit Affect Your Eligibility

How Does Reverse Mortgage Age Limit Affect Your Eligibility

Reverse Mortgage The Bank Pays You The Emi Forbes India

What Is The Reverse Mortgage Age Requirement In 2022

Reverse Mortgage Guide On Reverse Mortgage Loan Scheme

Reverse Mortgage Age Requirement When To Get A Reverse Mortgage Loan

Reverse Mortgage Technical Stuff Reverse Mortgage Guide Section 2 Article 6 Hsh Com